investment

Seminarie ‘EU-fondsen voor Bulgarije en Roemenië’

Kom te weten hoe u voordeel kan halen uit de EU-fondsen voor Bulgarije en Roemenië!

Organisatie: Flanders Investment & Trade, samen met AWEX.

Dit seminarie biedt Vlaamse bedrijven praktische informatie over hoe een beroep te doen op de EU-fondsen voor Bulgarije en Roemenië. Het programma verloopt in het Engels en u heeft de mogelijkheid de sprekers persoonlijk te ontmoeten tijdens de netwerklunch.

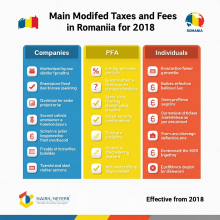

The main modified taxes and fees for companies and PFA and individuals in Romania for 2018

The Government and Parliament have operated in 2017 a series of changes to corporate tax and taxes, which apply in 2018. Some were adopted by the Government and modified by the Parliament on the last one hundred meters, while others have not yet succeeded exchanged by senators and deputies in due time, so that they can be applied from 1 January 2018 today all measures are implemented.

Uitnodiging voor een kennismaking. Tijdens dit gesprek kunnen we mogelijks 25-50 percent van uw sourcing problemen oplossen.

De blijvende schaarste van kandidaten zorgt voor een krappe markt en het wordt steeds moeilijker om kandidaten te vinden. Bedrijven gaan dan oplossingen zoeken in het buitenland. Als gevolg komen bedrijven die wel eens de technische realisatie hebben uitbesteed er vaak achter dat het één en ander mis kan gaan. Slechte communicatie en/of het resultaat wordt niet geleverd wat er verwacht wordt. Veel bedrijven willen daarom liever alles in huis houden. Zo kun je snel schakelen en heb je overzicht wat er allemaal gebeurt. Maar het kan anders.

Employer impact en het activeren van de openstaande vacatures – twee must DO’s als werkgever of hr manager

Employer branding is nu nog te vaak ‘nattevingerwerk of windowdressing’ en de meeste bedrijven hebben geen ervaring met ‘employer impact’. Vandaag komt het erop neer dat u de kandidaat beweegt om op de apply link te klikken van uw bedrijf. Vandaag komt het erop neer dat de kandidaat zich laat informeren over jobs in uw bedrijf omdat deze bij U wil werken. De kandidaat heeft de kontrole maar u kan impact hebben op de kandidaat en deze bewegen om actie te ondernemen.

Dit doet u niet alleen met ‘employer branding’ u dient ‘employer impact’ te hebben.

Service in the spotlight: “in house recruitment”

The “in house recruiter’ is an experienced interim manager specialized in recruitment.

Today the war for talent makes it hard to get an inflow of qualified personal.

The in house recruiter is the answer and remediation to this. The “in house recruiter makes the difference between traditional search agencies, traditional recruiters, specialized interim agencies and executive search agencies.

He will perform for you and find the right people in 60 days as he will work as part of your team in house in your offices.

The Romanian government introduces the obligation to initiate collective negotiations when applying the latest fiscal measures on transfer of contributions

As of 1 January 2018, pension and health insurance contributions are to be deducted directly from employees’ gross salaries . The Law mentioned as of 1 January 2018, the amount of social contributions paid on employment income will be as follows:

Contributions deducted from gross salaries:

Pension insurance contribution – 25%

Health insurance contribution – 10%

A work insurance contribution of 2.25% of the gross salary due by employers

Changes in the fiscal and labour code from 1 january 2018

We present some legislative news with impact in the field of labor law and tax law.

A. CHANGES IN THE FISCAL CODE

Government Emergency Ordinance no. 79/2017 for amending and completing the Law no. 227/2015 regarding the Fiscal Code.

The new normative act includes several changes to the tax regime, among which:

Jobs for Romanian experts in Belgium

Please visit the website for the current job openings:

Amendments to the conditions for application of income tax exemption to software engineers

More info and help: mail frjacobs@telenet.be

A new legislative Order has introduced changes regarding the tax exemption available on the wages of IT professionals. In order to decide who will benefit from said tax exemption certain conditions must be met, as follows:

• Reintroduction of the EUR 10,000 threshold

In order to benefit from the income tax exemption for software engineers, the employer must have earned at least EUR 10,000 per software engineer during the previous fiscal year.