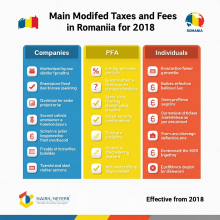

The Romanian government introduces the obligation to initiate collective negotiations when applying the latest fiscal measures on transfer of contributions

As of 1 January 2018, pension and health insurance contributions are to be deducted directly from employees’ gross salaries . The Law mentioned as of 1 January 2018, the amount of social contributions paid on employment income will be as follows:

Contributions deducted from gross salaries:

Pension insurance contribution – 25%

Health insurance contribution – 10%

A work insurance contribution of 2.25% of the gross salary due by employers