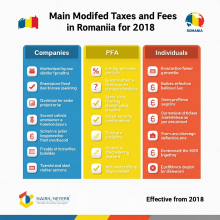

The main modified taxes and fees for companies and PFA and individuals in Romania for 2018

The Government and Parliament have operated in 2017 a series of changes to corporate tax and taxes, which apply in 2018. Some were adopted by the Government and modified by the Parliament on the last one hundred meters, while others have not yet succeeded exchanged by senators and deputies in due time, so that they can be applied from 1 January 2018 today all measures are implemented.